Today’s Tale of Two Housing Markets

Depending on where you live, the housing market could feel red-hot or strangely quiet right now. The truth is, local markets are starting to move in different directions. In some places, buyers are calling the shots. In others, sellers still hold the power. It’s a tale of two markets.

What’s a Buyer’s Market vs. a Seller’s Market?

In a buyer’s market, there are more homes for sale and not as many buyers. That means homes sit longer, buyers have more negotiating power, and prices tend to soften as a result. It’s simple supply and demand.

On the flip side, a seller’s market happens when there aren’t enough homes available for the number of people looking to buy them. Because buyers have to compete with each other to get the house they want, that leads to faster sales, multiple offers, and rising prices.

Right now, both of these scenarios are playing out, depending on where you are. So, how do you know what kind of market you’re in? Lean on a local real estate agent. They’ll explain what’s really happening in your area based on these key drivers.

The Number of Buyers and Sellers by Region

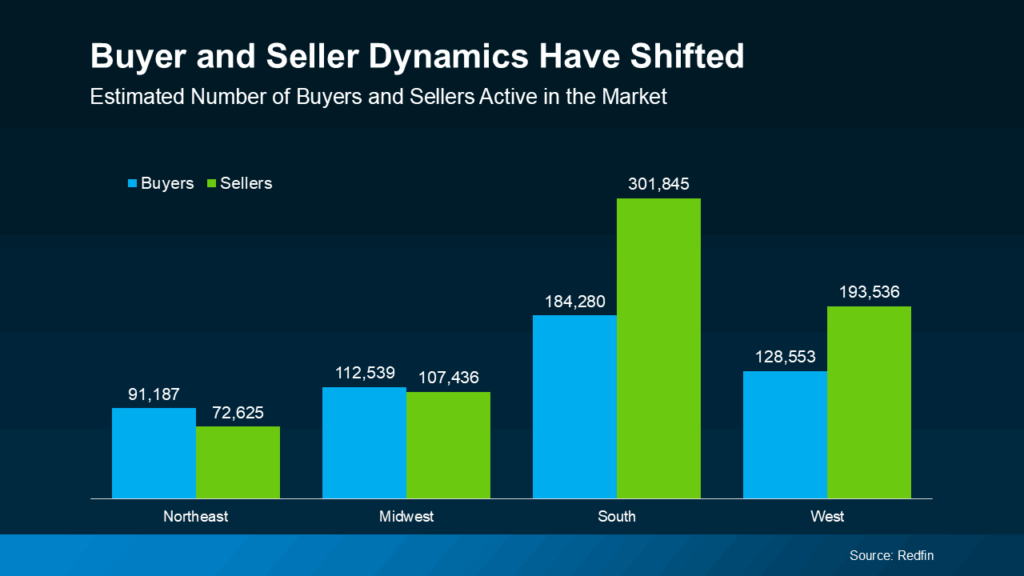

One of the biggest factors impacting each market is the number of active buyers and sellers. According to Redfin, here’s what that looks like by region (see graph below):

Today, the Northeast and Midwest are more likely to be seller’s markets. Buyers still outnumber sellers there, and that keeps things tilted in favor of homeowners. Generally speaking, homes are selling faster and prices are rising in those areas.

But the South and West are leaning more toward buyer’s markets. There are more sellers than buyers, which means more listings to choose from and less competition among buyers.

That’s a major shift from a few years ago when sellers had the advantage almost everywhere. Today, your local conditions matter more than ever – and they can vary even from one neighborhood to the next.

Price Trends Mirror the Buyer/Seller Divide

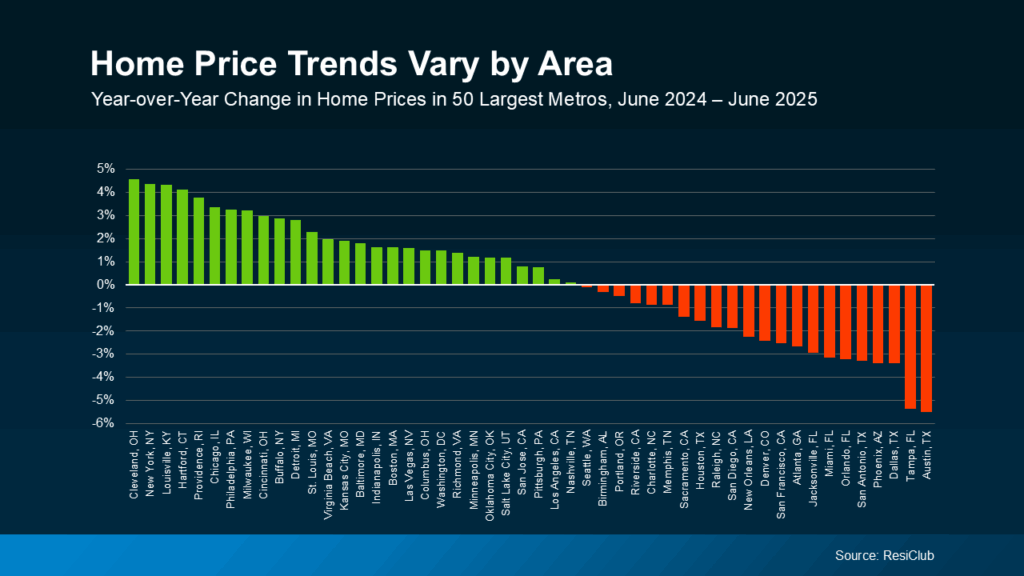

When inventory and buyer activity shift, so do prices. In places where demand still outpaces supply, like much of the Northeast and Midwest, prices are continuing to climb.

But in parts of the South and West where inventory is up and demand has cooled, prices are softening. And that’s a plus for buyers looking to negotiate in those areas.

Here’s the latest price data from ResiClub to show how this divide is shaking out across the top metros in the country (see graph below):

This is why it’s the tale of two markets. Roughly half of the top 50 metros are up, and half are relatively flat or down.

That said, don’t panic if you own a home in a market where prices are dipping. Most homeowners have built up significant equity over the past few years, and chances are you have too. So, you’re likely still come out way ahead when you sell.

Zooming In: Los Angeles Is a Market of Markets

Nowhere is the “real estate is local” truth more obvious than in Los Angeles. This city isn’t one market — it’s a mosaic of micro-markets, each with its own trends, price points, and demand levels.

You might see multiple offers and over-asking prices in places like Silver Lake, Mar Vista, or Valley hotspots like Studio City, Sherman Oaks, and parts of Encino, where inventory is tight and buyers are ready to pounce. Meanwhile, the pace slows in areas like Van Nuys, North Hollywood, and sections of Woodland Hills, where more listings, longer days on market, and price reductions give buyers a bit more room to negotiate.

The same goes for Downtown LA, the Hollywood Hills, and newer condo developments on the Westside, which are feeling the effects of more supply and cautious buyer behavior. Condos in general have been tougher to move lately, as many buildings face skyrocketing master insurance premiums or have lost coverage altogether — post-LA wildfires. That added layer of complexity has pushed some buyers toward single-family homes or more established buildings with solid reserves and updated insurance policies.

Then there’s my home area: West Hollywood. It’s a unique market that walks the line between lifestyle and investment. With its mix of architectural homes, high-design condos, and luxury new construction, WeHo operates on its own rhythm. Median prices hover around $1.4M, but standout listings still move quickly when they’re well-priced and prepped for today’s discerning buyer. It’s one of the few areas where both buyers and sellers can win — if they’ve got the right strategy.

And of course, the ultra-luxury zones — Malibu, Beverly Hills, Brentwood — play by entirely different rules. These markets are driven by global wealth, discretion, and lifestyle value, not interest rates. Homes here often sell well above $3.5M, usually all cash, and with minimal urgency. They behave more like long-term luxury assets than your typical real estate listing.

In LA, two homes, two miles apart can be in completely different markets. That’s why working with someone who knows the terrain — not just by zip code, but by street, style, and vibe — makes all the difference. Real estate here isn’t one-size-fits-all — it’s hyper-personal, hyper-local, and all about strategy.

Curious about what’s really happening in your neighborhood? I’ve got the real T on all the micro-markets I track daily — from West Hollywood to the Westside and beyond.

Reach out anytime if you want the inside scoop.

LET’S CONNECT: https://calendly.com/jed_i

Aloha!

I'm YOUR Real Estate JED.i and I love helping first time home buyers make their first home more affordable and I love helping sellers looking to move up to their forever home. Let's jump on a V.I.P. (Vision & Initial Possibilities) Call and see where you're at and I'll help you figure out next steps to getting you where you want to be!

Let's connect!

Contact

917.601.0038

8560 West Sunset Blvd

3rd Floor

West Hollywood, CA 90069

jed@realestate-jedi.com

Buy

JED.i JOURNAL

Sell

All Articles

schedule your V.I.P. consultation