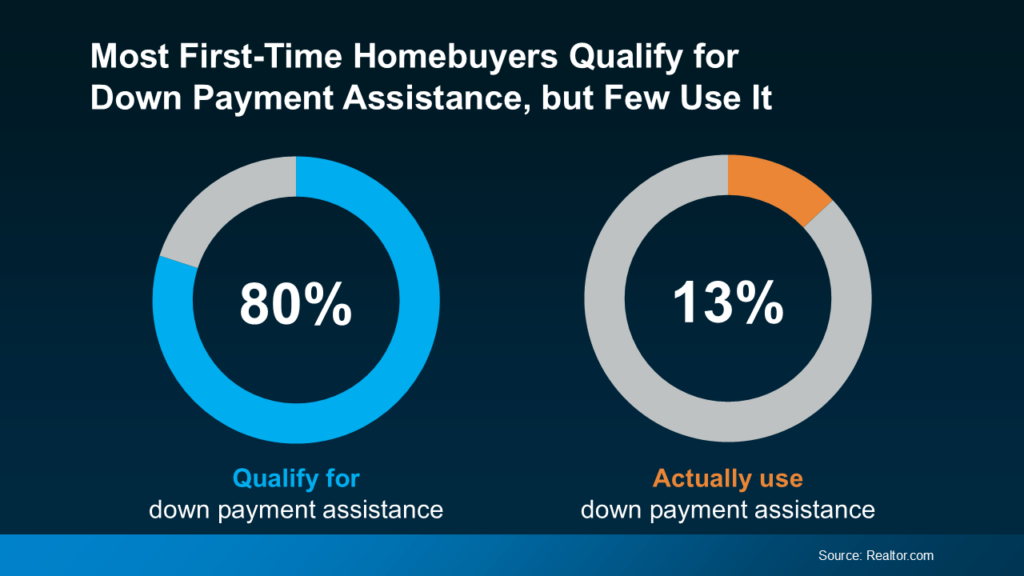

Did you know nearly 80% of first-time homebuyers qualify for down payment assistance, but only 13% actually use it? If you’re serious about buying a home, closing this gap is crucial. And if you’re buying in Los Angeles, there’s a unique program you should know about!

Here’s what you need to know to make the most of your down payment opportunities in today’s housing market.

Who Qualifies as a First-Time Homebuyer?

You might be surprised to learn that “first-time homebuyer” doesn’t necessarily mean it’s your first time buying a home. Many assistance programs define a first-time homebuyer as anyone who hasn’t owned a primary residence within the past three years. So, even if you’ve bought a home before, as long as three years have passed, you may qualify for down payment assistance and other first-time buyer benefits.

Amplify Your Down Payment Options

For first-time buyers, maximizing down payment resources is key. Some programs can speed up your homeownership journey faster than you might expect, and options in Los Angeles are especially worth exploring.

Exclusive Down Payment Program for Los Angeles Buyers

I’ve discovered a unique grant program specifically for Los Angeles, offering some fantastic benefits that can make a big difference in both the upfront and long-term costs:

- Low Down Payment: You may qualify for as little as 3% down.

- Generous Grant Assistance: This program offers up to $20,000 for down payments, closing costs, or interest rate reductions—and up to $50,000 in select areas!

- No Mortgage Insurance Required: Skip the extra monthly expense of mortgage insurance.

- Reduced Loan Origination Fees: Lower upfront costs.

- Flexible Use: Eligible for both home purchases and refinancing.

- Income Cap: Household income must be below $220,000 to qualify.

- Additional Benefits: Qualified applicants may access a checking account with waived maintenance fees and other perks from this specific bank.

To qualify, you’ll need a 30-year fixed-rate mortgage on a 1- to 4-unit primary residence in California. Other requirements include a minimum credit score of 660, income limits that vary by area, and completion of a HUD-approved homebuyer education course.

Don’t Let Rising Down Payment Headlines Scare You

With the average down payment rising, you may have seen reports indicating that it now averages $67,500 across the U.S. But that doesn’t mean down payment requirements are increasing. Many buyers are simply choosing to put more down to lower their monthly payments in the current high-interest-rate environment. Current homeowners are leveraging built-up equity to make higher down payments. As HousingWire explains:

“…buyers are putting down a higher percentage of the purchase price to lower their monthly mortgage payment. And buyers also had more equity from their home sales, which gives them more cushion.”

Here’s why buyers are opting for higher down payments:

- Lower Monthly Payments: For those who can manage a larger down payment, it helps reduce monthly housing costs.

- Built-Up Equity: Homeowners who’ve gained significant equity can put down more, which isn’t typically an option for first-time buyers.

Bottom Line

The best thing you can do is reach out to a trusted real estate advisor (that’s me!) who can guide you through this process. I’ll connect you with trusted, vetted lenders who specialize in down payment assistance programs, including this unique Los Angeles grant opportunity. Together, we’ll explore your options and make sure you have the support you need to achieve your homeownership goals. Let’s open your door to possibilities—I got you!

Aloha!

I'm YOUR Real Estate JED.i and I love helping first time home buyers make their first home more affordable and I love helping sellers looking to move up to their forever home. Let's jump on a V.I.P. (Vision & Initial Possibilities) Call and see where you're at and I'll help you figure out next steps to getting you where you want to be!

Let's connect!

Contact

917.601.0038

8560 West Sunset Blvd

3rd Floor

West Hollywood, CA 90069

jed@realestate-jedi.com

Buy

JED.i JOURNAL

Sell

All Articles

schedule your V.I.P. consultation